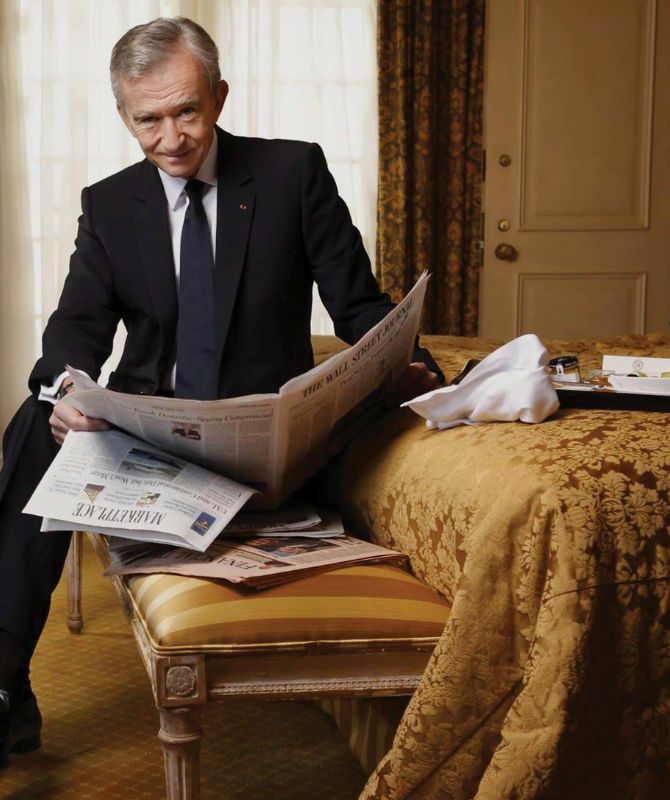

In the world of luxury, a subtle yet significant shift has caught the attention of industry insiders and investors alike. Bernard Arnault, the CEO of LVMH, recently made a move that speaks volumes about his strategic vision. Earlier this year, Arnault publicly praised Richemont, the esteemed owner of Cartier, even offering support to its chairman, Johann Rupert, in maintaining independence. It was an intriguing gesture that hinted at deeper intentions.

Fast forward to today, and reports from Bloomberg Businessweek have confirmed the speculation: Arnault has quietly acquired a personal stake in Richemont. The exact size of his investment remains undisclosed, described only as part of a broader strategy to diversify his investment portfolio. Both LVMH and Richemont have chosen to remain silent on the matter, adding to the intrigue surrounding this development.

The impact on Richemont’s stock was immediate, with shares surging up to 4% amidst renewed speculation of Arnault’s strategic interest. For Arnault, known for orchestrating LVMH’s dominance in luxury, acquiring Richemont would mean merging Cartier’s legacy with LVMH’s iconic brands like Tiffany, Bulgari, Louis Vuitton, and Dior. This consolidation could potentially redefine the luxury landscape, giving Arnault’s empire a commanding presence in luxury.

Financially, the acquisition would be substantial, with estimates ranging from 111 billion to 130 billion Swiss francs, depending on premiums.

Yet, the biggest challenge may lie in convincing Johann Rupert. With a significant equity stake and majority voting rights, Rupert has steadfastly maintained Richemont’s independence, rejecting previous acquisition overtures, including one from Kering. His leadership underscores the formidable resistance Arnault faces in his pursuit of Richemont.

Beyond financial implications, this potential merger holds broader strategic significance for the luxury market. It could reshape industry dynamics, influencing consumer trends and setting new standards in luxury branding. Arnault’s vision goes beyond expanding market share; it aims to shape the narrative of luxury’s future, balancing tradition with innovation.

While Arnault’s investment in Richemont is currently seen as a strategic financial move, its potential impact resonates deeply within the luxury sphere. As the saga continues to unfold, the world watches with anticipation, curious to see how this chapter in luxury history will be written.

ALSO READ: BURO’S WEEKEND PLAYBOOK: 5 EXCITING THINGS TO DO IN DUBAI THIS WEEKEND.